African Carbon Market – Scope 3 reduction investment strategy

The African Carbon Market – Scope 3 (ACM-Scope 3) Fund will be powered by carbon accounting technology that serves as a investment mechanism. We will develop this fund with asset management firms, the insurance industry, and large fashion companies.

The aim of the fund is to tie carbon savings in scope 3 emissions reductions with financial returns. The core economic activity is to divert textile waste from incineration and invest in ventures that transform textile waste into waste-to-value products.

This seeks to enable African inclusion in the global carbon cap-and-trade/ETS system. If your family is looking for a niche investment strategy that specifically activates Article 6

Enabling Article 6 of the Paris Agreement

Article 6 of the Paris Agreement enables international cooperation to tackle climate change and to unlock finance capital for developing countries. ACM-S3 works with companies and investors to reduce indirect scope 3 emissions through investment in textile waste-to-value solutions across Africa’s textile waste proliferation zones.

Scope 3 and Textile waste conversion carbon savings as a commodity

Most companies are great at measuring and reducing scope 1 and scope 2 emissions, however, scope 3 can often remain untapped and difficult to tackle. This can lead to minimal results in reducing scope 3 emissions.

ACM-S3 novel approach focuses on downstream supply chain scope 3 emissions reductions. According to the Ellen MacArthur Foundation, the fashion companies produces 92 million tonnes of textile waste per year. 25% of textile waste is incinerated.

Some of the textile waste is transported to developing countries. In Ghana, according to The Or Foundation, 15 million pieces of clothing arrive in Ghana’s informal second-hand fashion market per year and up to 40% comes in as waste. Ghana does not have the waste management capacity to manage the textile waste coming in.

Our on-the-ground research found that informal traders reported that when textile waste is given to informal waste collectors, it is often incinerated by the waste collectors.

Incinerating textile waste releases CO2 into the atmosphere in both the developed and the developing world.

To divert textile waste from landfill and incineration, ACM-S3 focuses on scope 3 emissions reduction that enables Article 6 of the Paris Agreement.

This strategy focuses on enabling strategies for Africa’s carbon market through circular economy investment in textile waste-to-value solutions

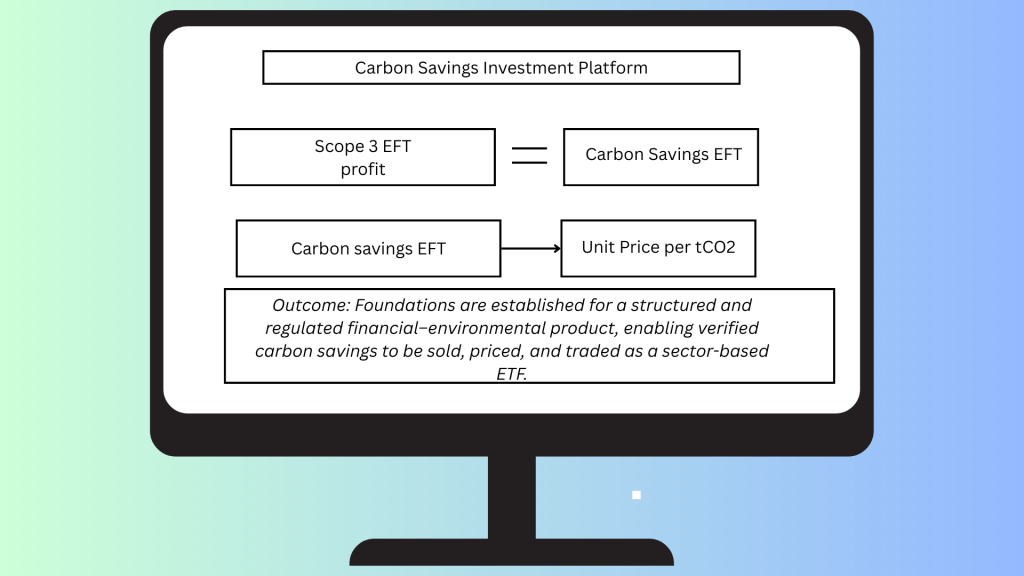

ACM S3 – “EFT” FUND

Current Service

Purpose:

A high-caliber, invitation-only membership designed for visionary leaders who want to shape the future of sustainable finance, activate Article 6 of the Paris Agreement, and participate in building a pioneering fund that converts CO2 savings into profit.

Equity share in UDS:

The private members club collectively owns 15% of the company for the sector development of the textile waste-to-value to enable UK/EU-African inclusion in global carbon markets.

This means members decide how to allocate the profits generated by that 15%.

Collectively, you can decide to:

- Reinvest in the business

- Fund new initiatives

- Distribute returns to members.

Fundraising amount needed:

Phase 1: £20,000 (Dec – Feb)

Value Proposition:

Early Adopter Advantage: This is not just an investment; it’s a leadership position in a fund and platform that will define the textile waste recycling sector for decades.

Generational Wealth Creation: Early members will receive equity and influence in a next-generation fund platform, designed to turn carbon savings and textile waste recycling into long-term investment returns.

Exclusive Access: Direct involvement in structuring the ACM-S3 scope-free fund and shaping the investment products from the ground up.

Impact with Profit: Members will participate in creating measurable environmental impact while unlocking financial upside through innovative, sector-defining investment products.

Networking at the Highest Level: Connect with the best minds in sustainable finance, waste management, and investment innovation—a true “who’s who” of future-focused industry leaders.

Membership Model:

Tiered Engagement: Some members may focus on advisory roles, others on operational or investment structuring.

Invitation-only to ensure high-quality contributors and decision-makers.

Active Participation: Members contribute to vision, strategy, and fund structuring.

Equity and Profit-Sharing: Long-term alignment with generational wealth creation.