JOIN THE ACM-S3 FUND CIRCLE

Coming soon

+BUILD AN EFT FUND FROM THE GROUND-UP IN A LUXURY, EXCLUSIVE PRIVATE MEMBERS CLUB

+ LEARN HOW TO INVEST IN EMERGING MARKETS (GHANA AND SOUTH AFRICA FOCUS)

+ ENABLE ARTICLE 6 OF THE PARIS AGREEMENT THROUGH INVESTING IN THE GROWTH OF AFRICAN CARBON MARKETS

+ SOLVE GLOBAL TEXTILE WASTE THROUGH UDS ETS-GLOBAL DEVELOPMENT INVESTMENT STRATEGY

WELCOME TO THE NEXT PHASE OF YOUR FAMILY’S INVESTMENT JOURNEY.

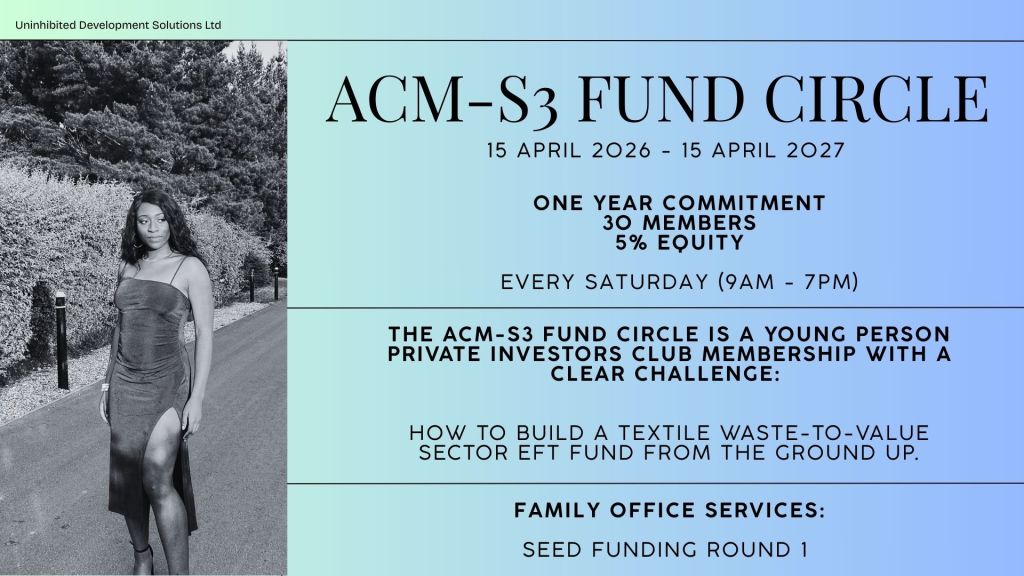

The ACM-S3 Fund Circle is Family Office Service offering we are launching as part of UDS Seed Funding round 1.

This is for 5% equity stake in UDS allocated to the private member club members exclusively

Intake: 30 members

Dates: April 2025 – April 2025 (liable to change based on financial stability)

Time: 9am – 7pm

Club Dates: Every Saturday (With a break between July – August)

Equity Stake per member: 0.167%

Minimum investment for private members place: £20,000

This is an opportunity for family offices to train young investors in ESG investors to activate Article 6 of the Paris Agreement in Africa through our ACM-S3 investment challenge.

The Young Investor Challenge

How to build Textile Waste-to-Value sector EFT Fund from the ground up?

This is an immersive cultural environment to serve as a training environment for the next generation of young investors and high net-worth families to look beyond impact investing and philanthropy in as an investment strategy in African.

Building on the pioneering work of Dambiso Moyo, Dead Aid, ACM-S3 Fund proposes alternative investment strategy that supports family offices to invest in the scaling textile waste-to-value ventures in the African market.

The ACM-S3 fund seeks to scale catalytic mergers and acquisitions that enables cutting-edge circular textile waste ventures to be further developed in partnerships with African textile recyclers

This investment approach drives African inclusion in the global carbon market through tradable scope 3 emission reductions. This solves the fundamental limitations of impact investing and philanthropy, where interventions does not position African economies to be price-setters in the global economies.

This limiting financialisation leaving African economies import-dependent, and does not enable the necessary levers of change to reduce modern slavery risks through compliance, transparent and oversight over supply chains.

Our private members club will be a learning environment to learn how to leverage carbon markets for profitable gender-lens investing that reduces modern slavery risks in informal economies in the second-hand fashion sector by scaling circular textile waste management and waste-to-value consumer markets across Africa.

The core focus is to scale Scope 3 Emissions reductions in the global fashion industry by tokenising the economic activity of textile waste conversions into waste-to-value products.

Under this private membership, the members will learn the best strategies to manage 10% of the ACM-S3 EFT fund (10% equity of UDS as the firm operating the fund) as a collective to embed our novel approach into the investment strategies of Family Offices.

The promise of future equity will be issued to members who fulfil the one-year commitment to the programme.

What is included?

Who is it for?

- Gen Z and Millennials, Young Investors, seeking to embed our novel approach into their family office investment strategy and is committed to the ground work of learning this approach.

- People who are up for the difficult level of our investment strategy and are confident in integrating the learning into their investment strategy in emerging markets.

- Works best for family offices already invested and/or have build companies in sustainable and circular fashion, waste management and insurance.

- Young investors seeking to embed carbon market and carbon accounting into their investment strategy as a future skill beyond the numbers

- People that enjoy in-person environment to create bonds like-minded individuals and enjoys collaboration and information sharing to optimise the fund.

- Those who are interested in cultural immersion in wellness and fitness to build respect and understanding diverse African cultures to enable co-creation and equitable trade relations